Offshore Trust Services: Your Course to Tax-Efficient Riches Management

Wiki Article

Charting New Horizons: Broadening Your Wide Range Management Portfolio With Offshore Count On Solutions

The Advantages of Offshore Count On Providers in Wealth Monitoring

You'll be astonished at the advantages of overseas trust fund services in wide range administration. Offshore count on solutions supply a vast array of benefits that can considerably improve your riches management portfolio. First of all, one of the essential advantages is the ability to protect your properties. By establishing an overseas trust, you can protect your riches from prospective creditors, claims, and other monetary dangers. offshore trust services. This gives you with a feeling of security and satisfaction knowing that your assets are well-protected.Secondly, overseas depend on services supply improved privacy. Unlike standard onshore trust funds, offshore depends on supply a greater degree of personal privacy and discretion. This can be specifically helpful for people that value their financial personal privacy and desire to maintain their properties away from spying eyes.

Furthermore, offshore counts on supply tax obligation advantages. Lots of offshore jurisdictions supply favorable tax obligation programs, permitting individuals to legally decrease their tax responsibilities. By making use of overseas trust fund services, you can reduce your tax obligation commitments and keep a larger part of your riches.

Moreover, overseas trusts allow global diversification. By purchasing foreign markets and holding assets in different jurisdictions, you can spread your threat and potentially raise your financial investment returns. This diversification method can help you attain lasting economic growth and stability.

Key Factors To Consider for Integrating Offshore Depends On Into Your Portfolio

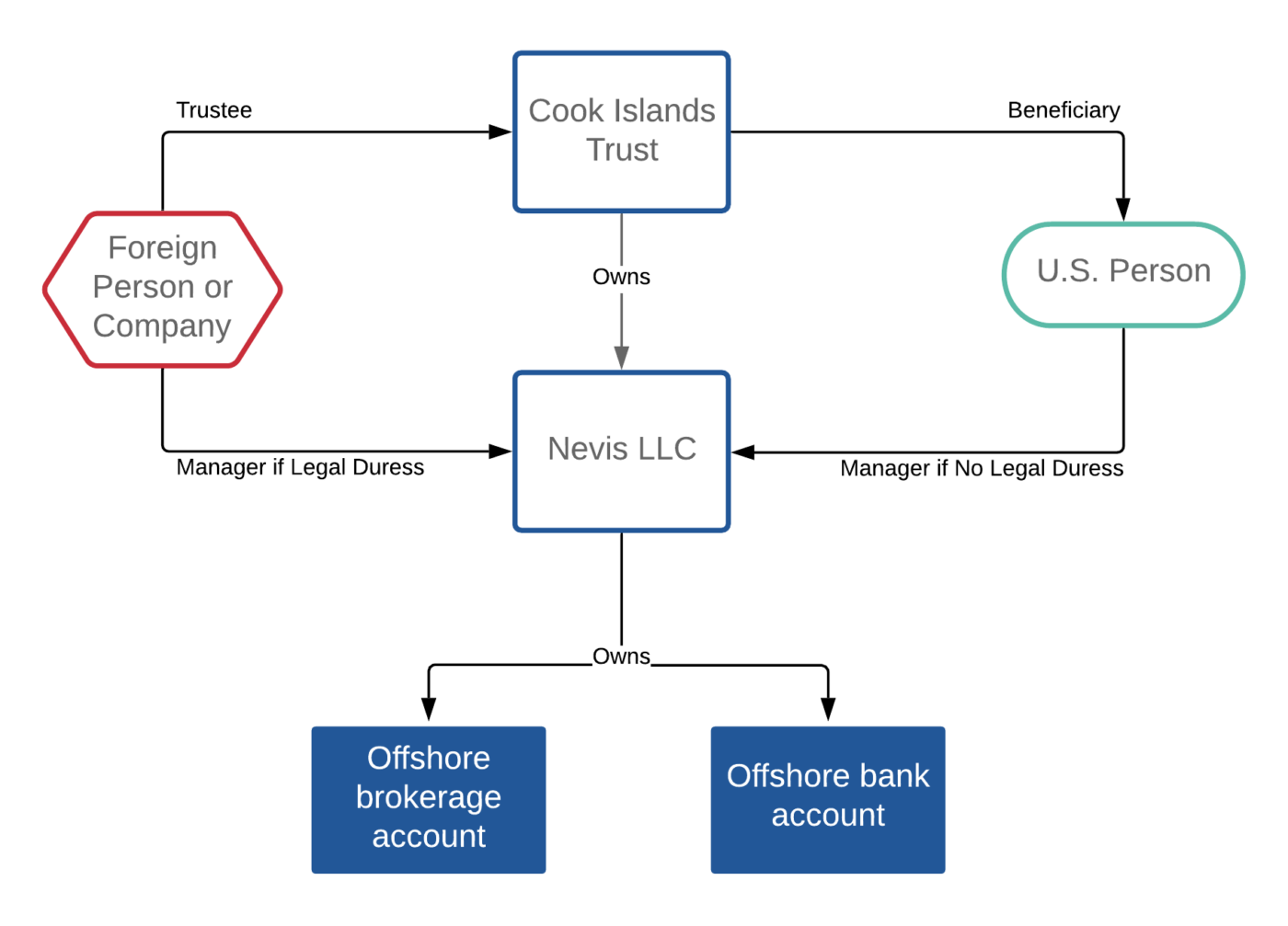

When incorporating overseas depends on into your investment technique, it is necessary to think about vital factors. Offshore trusts can use many benefits, such as possession defense, tax benefits, and personal privacy. Prior to diving into this type of investment, you require to meticulously evaluate your goals and purposes.First of all, it's vital to choose the ideal jurisdiction for your overseas trust fund. Various nations have various legislations and laws, so you require to discover a territory that straightens with your particular requirements. You must consider variables such as political stability, legal framework, and track record.

Second of all, you must thoroughly research study and choose a credible trustee to handle your offshore trust fund. The trustee plays a vital duty in protecting and administering your properties. Look for a trustee with a strong record, knowledge in overseas trust monitoring, and strong financial stability.

Additionally, you need to know the coverage needs and tax implications related to offshore depends on. It's important to abide by all relevant regulations and laws to avoid any lawful problems or fines in your house country.

Finally, it's vital to routinely assess and monitor your overseas depend on to guarantee it continues to be lined up with your investment objectives. Economic and political adjustments can impact the efficiency of your trust, so staying informed and aggressive is important.

Exploring International Jurisdictions for Offshore Trust Solutions

Choosing the ideal jurisdiction is vital when discovering global choices for offshore depends on. With so many countries supplying offshore trust fund solutions, it is vital to think about different variables before making a choice.One more vital factor to consider is the tax obligation benefits offered by the jurisdiction. Various countries have various tax legislations and guidelines, and some might use a lot more positive tax obligation prices or exceptions for offshore depends on. By very carefully assessing the tax obligation implications of each territory, you can maximize your wide range and decrease your tax obligation responsibilities.

Lastly, consider the ease of from this source doing business in the jurisdiction. Search for nations with solid economic infrastructure, reliable regulative structures, and a supportive company setting.

Optimizing Tax Obligation Performance With Offshore Trust Structures

Maximizing tax obligation performance can be attained through offshore trust structures you can check here that use desirable tax rates and exceptions. By developing an overseas trust, you can purposefully handle your wide range and decrease your tax obligation responsibilities.One of the essential advantages of offshore counts on is the ability to postpone tax obligations. By placing your possessions in a trust, you can delay the repayment of taxes until a later date or also avoid them entirely in some instances. This can be particularly beneficial for people with significant investment earnings or those who expect future tax increases.

In addition, offshore depends on offer a level of privacy and property defense that you might not locate in your house territory. By positioning your assets in an overseas depend on, you can protect them from legal conflicts and possible financial institutions. This can give comfort and protect your wide range for future generations.

It is necessary to note that while overseas trust funds use tax obligation advantages, it is important to abide by all relevant tax obligation regulations and laws. offshore trust services. Working with experienced professionals that concentrate on overseas depend on structures can guarantee that you make the most of tax obligation performance while staying totally certified with the legislation

Mitigating Danger and Enhancing Property Protection With Offshore Counts On

To reduce danger and improve property defense, you can rely upon overseas trust funds, which supply a degree of personal privacy and legal protection that may not be available in your home jurisdiction. Offshore trusts provide a calculated solution for protecting your wealth by placing your assets in a separate legal entity outside of your home country. By doing so, you can secure your properties from potential lenders, suits, and other threats.Among the main benefits of utilizing overseas counts on is the degree of personal privacy they pay for. Unlike in your house territory, where your economic info may be conveniently accessed by government authorities or other interested parties, offshore counts on provide a higher level of confidentiality. Your financial and individual information are maintained click to read more personal, enabling you to maintain a better level of control over your assets.

Furthermore, offshore counts on can offer enhanced property defense. In the occasion of litigation or financial problems, having your possessions in an overseas count on can make it harder for creditors to reach them. The count on acts as an obstacle, offering an added layer of defense and making it harder for any individual seeking to take your assets.

In addition to personal privacy and possession protection, overseas depends on can additionally offer tax benefits, which further add to your general risk reduction technique. By meticulously structuring your trust fund, you can possibly lessen your tax obligation obligations and optimize your estate preparation.

Final Thought

In verdict, by incorporating offshore trust solutions right into your wealth management profile, you can take pleasure in various advantages such as tax effectiveness, asset defense, and access to global territories. It is very important to thoroughly think about crucial aspects when choosing overseas depends on, such as online reputation, regulatory framework, and expert expertise. With proper preparation and support, you can expand your financial investment horizons and secure your wide range in a globalized world. Don't lose out on the opportunities that offshore trust fund solutions can offer to expand and safeguard your riches.Unlike typical onshore depends on, offshore trusts give a greater degree of privacy and discretion. Offshore counts on can use numerous advantages, such as asset protection, tax advantages, and privacy. Different nations have different tax obligation legislations and guidelines, and some might provide much more beneficial tax obligation rates or exemptions for overseas trust funds.Taking full advantage of tax obligation performance can be accomplished via offshore trust fund structures that offer desirable tax prices and exemptions.In final thought, by incorporating overseas trust fund services right into your riches monitoring portfolio, you can appreciate countless advantages such as tax performance, possession defense, and access to international jurisdictions.

Report this wiki page